Secondary advisory boutique backed by a network of 500+ institutional investors and family offices

Scroll down

Scroll down

to get more informations

to get more informations

Secondary advisory boutique backed by a network of 500+ institutional investors and family offices

Scroll down

to get more informations

Some of the transactions we worked on

Some of the transactions we worked on

Includes transactions led by the team prior to Clifton Partners*

Some of the transactions we worked on

Includes transactions led by the team prior to Clifton Partners*

Secondary advisory for founders, GPs, & family offices

We structure and execute private tech secondaries, matching sellers with top-tier capital to unlock liquidity in an opaque, relationship-driven market.

We structure and execute private tech secondaries, matching sellers with top-tier capital to unlock liquidity in an opaque, relationship-driven market.

$

B+

Advised

$

M

Average

Transaction Size

%

Cross-Over Transactions

What We Do

What We Do

Every secondary transaction is unique. We understand the nuances and design tailored solutions aligned with founders’, GPs’, and investors’ strategic and liquidity goals.

Every secondary transaction is unique. We understand the nuances and design tailored solutions aligned with founders’, GPs’, and investors’ strategic and liquidity goals.

What We Do

Every secondary transaction is unique. We understand the nuances and design tailored solutions aligned with founders’, GPs’, and investors’ strategic and liquidity goals.

Tailored liquidity solutions

We advise founders, GPs, and early backers on minority stake sales, navigating approvals, transfer restrictions, and cap table dynamics. Beyond direct sales, we structure bespoke liquidity solutions to optimize pricing and execution through a confidential process.

Tailored liquidity solutions

We advise founders, GPs, and early backers on minority stake sales, navigating approvals, transfer restrictions, and cap table dynamics. Beyond direct sales, we structure bespoke liquidity solutions to optimize pricing and execution through a confidential process.

Tailored liquidity solutions

We advise founders, GPs, and early backers on minority stake sales, navigating approvals, transfer restrictions, and cap table dynamics. Beyond direct sales, we structure bespoke liquidity solutions to optimize pricing and execution through a confidential process.

Portfolio liquidity management

We provide end-to-end advisory on portfolio transactions, from pricing and positioning to buyer outreach and execution. We support tender offers and large GP-led transfers, delivering efficient outcomes aligned with long-term capital strategies.

Portfolio liquidity management

We provide end-to-end advisory on portfolio transactions, from pricing and positioning to buyer outreach and execution. We support tender offers and large GP-led transfers, delivering efficient outcomes aligned with long-term capital strategies.

Portfolio liquidity management

We provide end-to-end advisory on portfolio transactions, from pricing and positioning to buyer outreach and execution. We support tender offers and large GP-led transfers, delivering efficient outcomes aligned with long-term capital strategies.

Access to a unique investor network

We offer direct access to a global network of leading secondary buyers, crossover funds, and institutional capital. This enables fast execution, precise pricing, and informed investor selection across regions and sectors.

Access to a unique investor network

We offer direct access to a global network of leading secondary buyers, crossover funds, and institutional capital. This enables fast execution, precise pricing, and informed investor selection across regions and sectors.

Access to a unique investor network

We offer direct access to a global network of leading secondary buyers, crossover funds, and institutional capital. This enables fast execution, precise pricing, and informed investor selection across regions and sectors.

Who we are

Who we are

Who we are

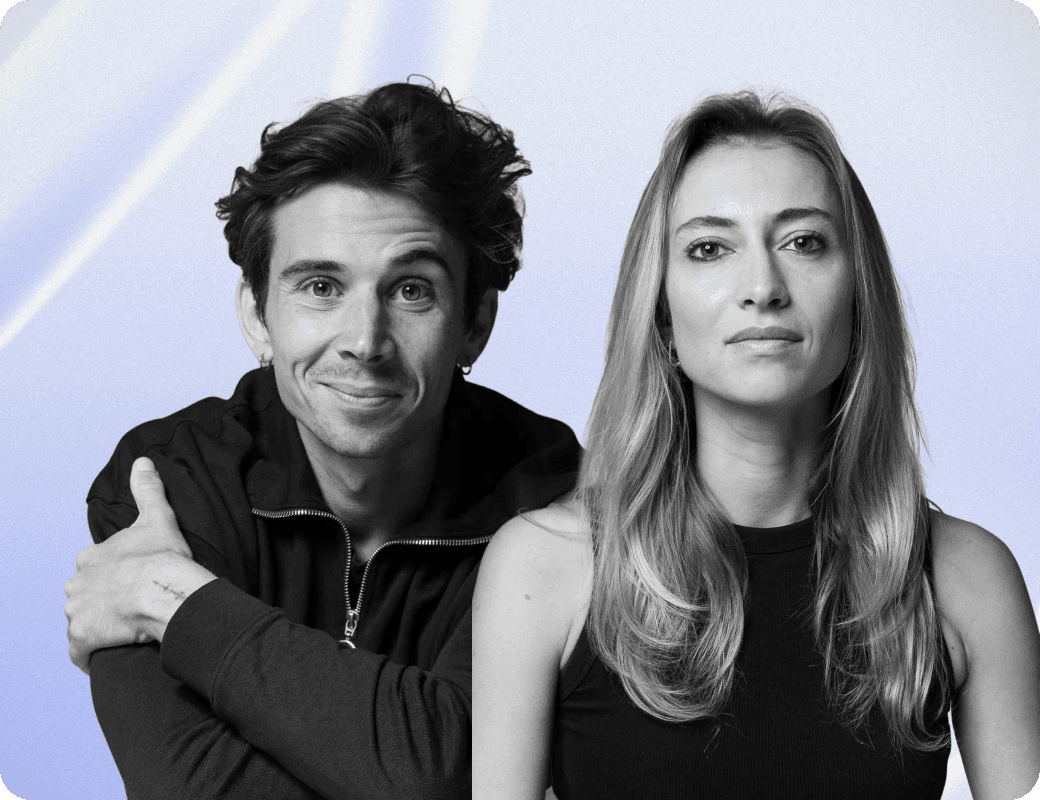

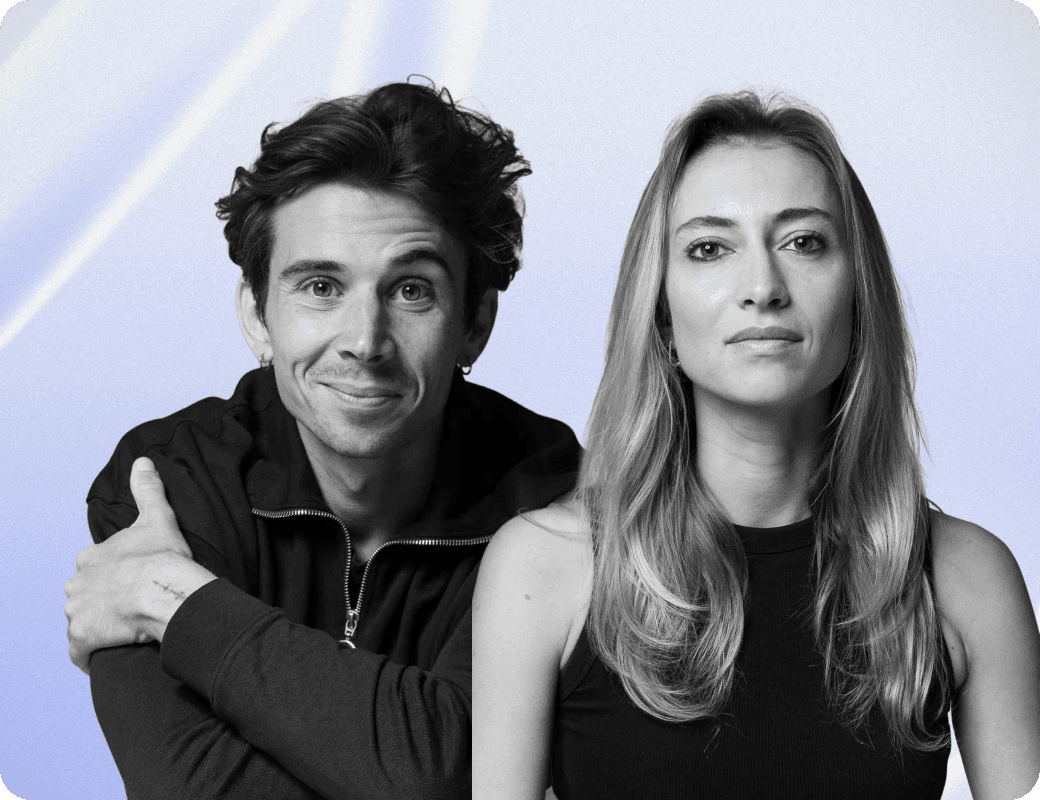

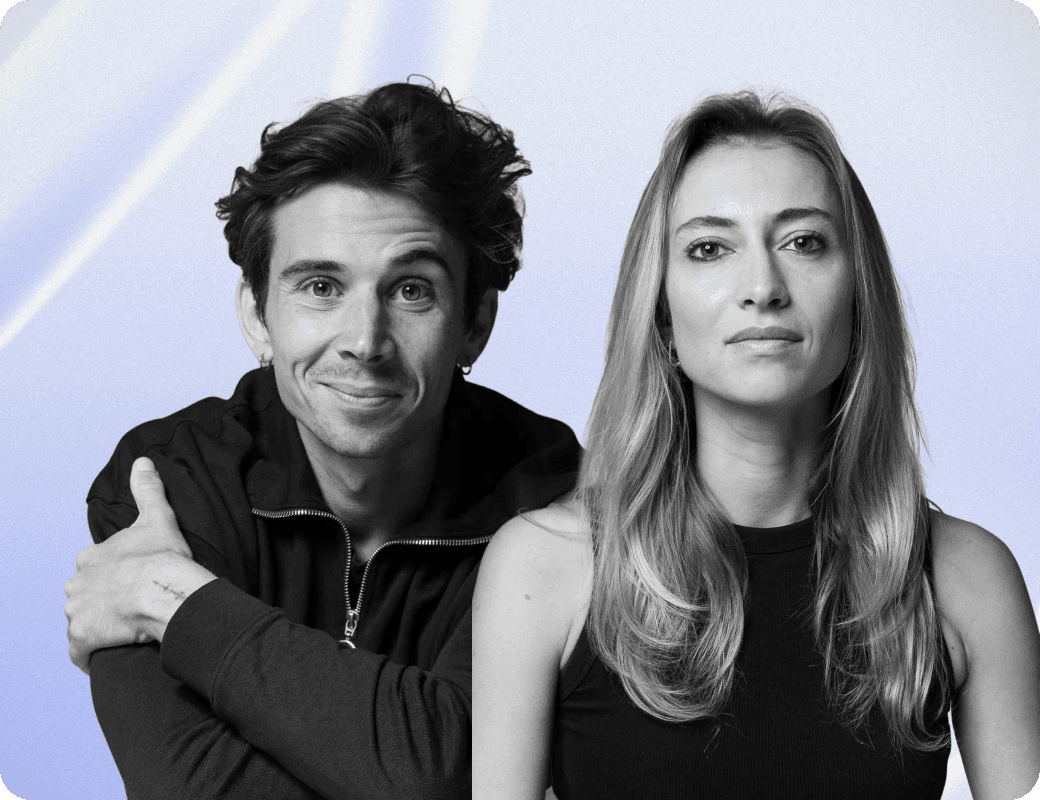

Diane-Rose Dupré

Diane-Rose Dupré

Structuration. Strategy. Network.

Structuration. Strategy. Network.

Founding Partner

Diane brings a decade of experience at UBS, where she became the youngest team head in UBS France, leading the Venture & Growth Solutions team. She structured and executed tailored secondary solutions for some of Europe’s most iconic companies, including Revolut, Klarna, Anthropic, OpenAI, and SpaceX.

Based between London and Paris, she has worked closely with leading family offices and industrial investors, building a deep, trusted network of long-term capital globally.

Diane-Rose Dupré

Structuration. Strategy. Network.

Founding Partner

Diane brings a decade of experience at UBS, where she became the youngest team head in UBS France, leading the Venture & Growth Solutions team. She structured and executed tailored secondary solutions for some of Europe’s most iconic companies, including Revolut, Klarna, Anthropic, OpenAI, and SpaceX.

Based between London and Paris, she has worked closely with leading family offices and industrial investors, building a deep, trusted network of long-term capital globally.

Guillaume Moubeche

Guillaume Moubeche

Vision. Access. Upside.

Vision. Access. Upside.

Founding Partner

Founder of multiple profitable SaaS companies, including lemlist, started with $1000 and valued at $150M when he sold 20% for $30m in 2021 (still 70% owned).

He built one of the most trusted communities of tech founders and investors globally while investing millions in tech companies like Groq, Ledger, Backmarket and many more…

Together, they combine the discipline of institutions with the instinct of builders.

Guillaume Moubeche

Vision. Access. Upside.

Founding Partner

Founder of multiple profitable SaaS companies, including lemlist, started with $1000 and valued at $150M when he sold 20% for $30m in 2021 (still 70% owned).

He built one of the most trusted communities of tech founders and investors globally while investing millions in tech companies like Groq, Ledger, Backmarket and many more…

Together, they combine the discipline of institutions with the instinct of builders.

What Our Clients Say

What Our Clients Say

Every secondary transaction is unique. We design tailored liquidity solutions for founders, GPs, and investors, leveraging global execution experience across regions where local dynamics shape outcomes.

Every secondary transaction is unique. We design tailored liquidity solutions for founders, GPs, and investors, leveraging global execution experience across regions where local dynamics shape outcomes.

What Our Clients Say

Every secondary transaction is unique. We design tailored liquidity solutions for founders, GPs, and investors, leveraging global execution experience across regions where local dynamics shape outcomes.

Clifton Partners runs one of the most disciplined secondary processes we’ve seen. Clear positioning, aligned counterparties, and a level of discretion that is essential at this end of the market.

Clifton Partners runs one of the most disciplined secondary processes we’ve seen. Clear positioning, aligned counterparties, and a level of discretion that is essential at this end of the market.

Clifton Partners runs one of the most disciplined secondary processes we’ve seen. Clear positioning, aligned counterparties, and a level of discretion that is essential at this end of the market.

What stood out was the quality of access and the discipline of the process. No broad outreach, no pressure. Just well-curated opportunities, strong information, and thoughtful structuring. That’s rare in secondaries

Chief Investment Officer

CIO, European Family Office

What stood out was the quality of access and the discipline of the process. No broad outreach, no pressure. Just well-curated opportunities, strong information, and thoughtful structuring. That’s rare in secondaries

Chief Investment Officer

CIO, European Family Office

Diane and Guillaume combine institutional rigor with a real understanding of founder and investor psychology. They handled a complex portfolio transaction end to end, with excellent pricing outcomes and zero friction.

General Partner

in a leading European fund

Diane and Guillaume combine institutional rigor with a real understanding of founder and investor psychology. They handled a complex portfolio transaction end to end, with excellent pricing outcomes and zero friction.

General Partner

in a leading European fund

We needed a liquidity solution that preserved long-term alignment while delivering meaningful exit options to LPs. Clifton designed a structure that achieved both. Professional, precise, and trusted counterparties throughout.

Managing Partner

in a Middle East SWF

We needed a liquidity solution that preserved long-term alignment while delivering meaningful exit options to LPs. Clifton designed a structure that achieved both. Professional, precise, and trusted counterparties throughout.

Managing Partner

in a Middle East SWF

What stood out was the quality of access and the discipline of the process. No broad outreach, no pressure. Just well-curated opportunities, strong information, and thoughtful structuring. That’s rare in secondaries

Chief Investment Officer

CIO, European Family Office

Diane and Guillaume combine institutional rigor with a real understanding of founder and investor psychology. They handled a complex portfolio transaction end to end, with excellent pricing outcomes and zero friction.

General Partner

in a leading European fund

We needed a liquidity solution that preserved long-term alignment while delivering meaningful exit options to LPs. Clifton designed a structure that achieved both. Professional, precise, and trusted counterparties throughout.

Managing Partner

in a Middle East SWF

Get in Touch

Get in Touch

Every secondary transaction is unique. We understand the nuances and design tailored solutions aligned with founders’, GPs’, and investors’ strategic and liquidity goals.

Every secondary transaction is unique. We understand the nuances and design tailored solutions aligned with founders’, GPs’, and investors’ strategic and liquidity goals.

Get in Touch

Every secondary transaction is unique. We understand the nuances and design tailored solutions aligned with founders’, GPs’, and investors’ strategic and liquidity goals.

Book a meeting with Diane

Find a time that suits you best Feel free to message us directly for urgent matter.

Book a meeting with Diane

Find a time that suits you best Feel free to message us directly for urgent matter.

Book a meeting with Diane

Find a time that suits you best Feel free to message us directly for urgent matter.

Message us

You can either send us a message directly on Whatsapp or send us an e-mail on d@clifton.partners

Message us

You can either send us a message directly on Whatsapp or send us an e-mail on d@clifton.partners

Message us

You can either send us a message directly on Whatsapp or send us an e-mail on d@clifton.partners